[media id=13 width=320 height=240]

[media id=13 width=320 height=240]

The slow steady erosion of Wendover’s gaming win continued into March according to this week’s report from the state Gaming Board.

Released Tuesday the report showed total Wendover gaming win down 1.31 percent from March 2010 to $14.66 million.

“Win” is a gross figure, with no operating costs or other expenses deducted. And it’s casino revenue only _ separate from hotel, restaurant or bar revenues generated by the resorts.

While win indicates a casino market’s profitability another statistic “play” is an indicator of how casino workers are fairing. With some casino workers dependent on tips for up to half of their total income, play, the amount of money wagered by gamblers is a good indicator of how much casino workers received in tips and how many gamblers are actually in the casino.

Wendover casinos have seen both their win and play numbers on a general decline since the Great Recession hit the border town in 2007. Currently the Nevada/Utah border town is running close to 20 percent less in gaming win than it was during its heydays of the mid-2000’s.

March 2007 win total for example was over $4 million great than the same month in 2011.

According to the report slot win was off 3.8 percent to $11.1 million. Slot play was down 1.9 percent to $198.5 million. Slot hold declined from 5.69 percent to 5.58 percent.

Win from tables games and sports betting was however up 8.0 percent to $3.3 million. Table play increased 2.6 percent to $9.2 million. Hold on the tables increased from 19.9 percent to 21.12 percent.

Wendover’s most popular game Blackjack reported a total win of $1.9 million up 5.2 percent. Blackjack play increased 2.6 percent to $9.2 million. Hold declined from 21.51 to 21.02.

March was the sixth consecutive month Wendover clubs reported a total win drop.

The balance of Elko County reported yet another increase helped by the mining boom. Slot win in Elko, Wells and jackpot reported an 8.7 percent increase to $8.1 million. Slot play was up 11.9 percent to $117 million. Slot hold dropped from 7.14 percent to 6.94 percent.

For the first time in more than half a year win on the tables broke the 41 million threshold at an even $1 million. Play was up 18.5 percent to $4.7 million while hold declined from 24.38 percent to 21.28 percent.

[media id=1 width=320 height=240]

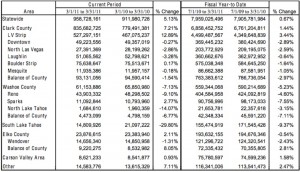

In the entire state, Nevada’s casinos have managed to end four months of decline after recording a 5.1% increase in their revenue for March to $958.7 million compared to $911.98 million a year earlier.

Traditionally, casinos situated along the Las Vegas Strip generate around half the gambling revenue collected in Nevada and March saw an impressive 12.9% rise in their takings to reach $527.3 million.

The Strip casinos’ strong performance was boosted by a 55.1% increase in baccarat win to $81.8 million, a 23.9% increase for blackjack to $83.8 million, and a 62.4% rise in roulette revenue. The Strips slot machine revenue was also up 0.9% from a year earlier to $260.2 million.

Commenting on the promising figures, gaming analyst David Katz from Jefferies & Co said: “We believe these results support our view of a gradual recovery on the Strip followed by a more pronounced lag in the locals market. The data reveals important qualitative and directional indications for the overall health of the Las Vegas market. We view March casino revenue trends (excluding baccarat) as largely within our expectations of a slow and tentative casino revenue recovery.”

Elsewhere around the state, Elko County posted a 2.1% increase in revenue, Carson Valley area was up 0.9%, while Clark County posted a slight gain of 0.1%,

On the other side of the coin, South Lake Tahoe fell 29.8%, Washoe County fell 7.3%,

Laughlin was down 3.2%, North Las Vegas was down 2.8%, Downtown Las Vegas fell 0.2%, while Mesquite was off by 0.1%.

The overall figures indicate that although the Las Vegas Strip seems to be improving, other neighboring casinos which depend on local markets are continuing to struggle. As Nevada senior control board analyst Mike Lawton explains:

“We’re waiting for a broader recovery that will spill over to the local markets. Their losses are narrowing and we’re continuing to monitor it.”

Finally, a third of Nevada’s fund revenues come from casino taxes and in April the state collected $79.63 million in fees, down 0.35% from a year earlier.