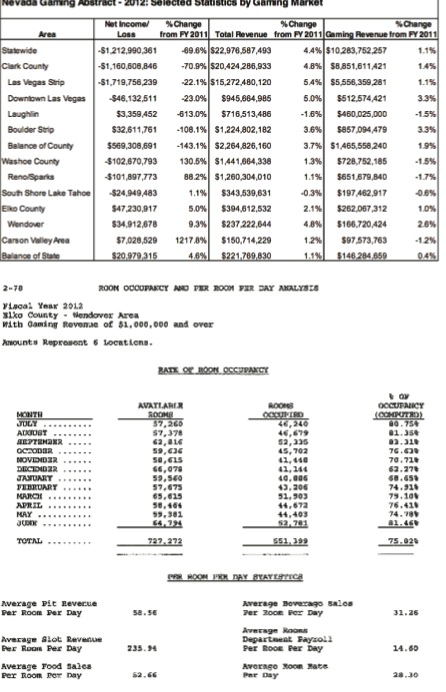

Wendover Casinos bucked a state wide trend reporting an increase in earning for 2012, reported the Nevada Gaming Commission.

Wendover clubs showed total revenues increase by almost 5.0 percent to $237,000 and gaming revenues increase 2.6 percent to $167,000. Total gaming income at $35,000 increased by 9.3 percent.

But while there was an increase Wendover casinos are still nowhere near their profit their peak profit levels hit in 2008 before the great recession.

[media id=1 width=320 height=240]

Things could be worse, Nevada’s entire casino industry suffered through its fourth straight fiscal year net loss despite a 4.4 percent growth in total revenues over the 12-month period, according to the annual Gaming Abstract, which released Wednesday by the Gaming Control Board.

The report compares revenues and income produced by casinos generating more than $1 million in gaming revenues during the fiscal year, which ended June 30.

The report compares revenues and income produced by casinos generating more than $1 million in gaming revenues during the fiscal year, which ended June 30.

In 2012, the abstract included results from 265 casinos statewide. Together, the casinos generated a net loss of $1.21 billion on total revenues of more than $22.9 billion. In fiscal 2011, 256 casinos generated a net loss was almost $4 billion on revenues of $22 billion.

Total revenue covers the money spent by casino customers on gaming, rooms, food, beverage, and other attractions. The net loss was the money retained by casinos after expenses have been paid but before deducting federal income taxes and prior to accounting for extraordinary expenses.

Control Board senior research analyst Michael Lawton said the general expense line for “other expenses” was main reason for the net loss narrowing by almost 70 percent.

In fiscal 2011, the line item included asset right downs, impairment charges, and other matters related to gaming industry bankruptcy reorganizations and financial restructuring efforts.

In fiscal 2012, the restructuring efforts slowed. The figure was $1.3 billion, a decrease of 60.8 percent compared with $3.4 billion in 2011.

“That number is stabilizing,” Lawton said, adding that the 2012 figure was the lowest number in that category since fiscal 2004.

Some revenue categories such as food and beverage as well as hotel revenues are either near or slightly above the peak years, Lawton added.

Some revenue categories such as food and beverage as well as hotel revenues are either near or slightly above the peak years, Lawton added.

“The big drag is gaming revenue which is about 17 percent still off its peak,” lawton added. “What we are seeing is a change in how tourists are spending. They are still coming and spending but they are spending it differently.”

Gaming revenue accounted for almost $10.3 billion, or 44.8 percent of total revenue, the 14th consecutive year that non-gaming revenues outpaced gaming revenues. In 2011, gaming revenue accounted for 46.2 percent of the total revenues statewide.

“Customer spending patterns have been changing over the years,” Lawton said. “With 55.2 percent of the total revenues, non gaming spending was the highest combined share ever in the abstract.”

Statewide, gaming revenues in the fiscal year grew 1.1 percent over 2011.

Revenues produced from hotel rooms were $4.7 billion, up 8.7 percent from a year ago; revenues from food sales were $3.5 billion, up 6.3 percent; beverage sales were $1.6 billion, up 8.7 percent; and other revenues, which includes retail and shows, was $2.9 billion, an increase of 5 percent.

On the Strip, the divide was more pronounced.

Total revenues on the Strip during the fiscal year were almost $15.3 billion, a 5.4 percent increase over 2011. Gaming revenues were almost $5.6 billion, a 1.1 percent increase but just 36 percent of the overall total.

Total revenues on the Strip during the fiscal year were almost $15.3 billion, a 5.4 percent increase over 2011. Gaming revenues were almost $5.6 billion, a 1.1 percent increase but just 36 percent of the overall total.

In fiscal 2012, 70 casinos owned by publicly traded companies accounted for 78 percent of state’s total gaming revenue generated during the fiscal year.

The 265 casinos paid $799.6 million in gaming taxes and fees during the fiscal year, which equated to 7.8 percent of their gaming revenue.