What To Bring The Tax Preparer

While a plate of cookies may be nice to bring a hostess, what your tax preparer would prefer (at least in the office) is that you bring in the proper paperwork. Here’s a list of the most likely paperwork to provide:

What You’ll Need

1. Last year’s return, the last two years if this is your first appointment. Chances are much of the information—Social Security numbers, address and the like—will be the same, saving everybody time and reducing the risk of errors.

2. Your W-2. W-2s must be mailed to employees by January 31. They show your income and how much you’ve already paid in income taxes. If you’ve had more than one job this year, you need a W-2 form from each of them.

3. 1099s. If you’re a freelancer or part-time worker, you should have 1099 forms from everyone for whom you’ve worked this year. These forms are also used to report earned interest, cancellation of debt, dividends received and proceeds from broker transactions.

4. Receipts for donations. Keep the receipts for all charitable event sponsorships, money or food for holiday charities and any other money donations. Keep a list of items and the values you assigned them along with the receipts for any household goods, toys and clothing donations. If you volunteer, keep a record of your mileage and other expenses.

5. 1098 forms. Homeowners can deduct mortgage interest. Also deductible are student loan interest and tuition paid to colleges and universities.

6. If you have a home office, you can deduct some of your rent, mortgage, utilities and so on. Bring any relevant receipts.

7. If you’ve been looking for work, bring receipts for whatever the search has cost you—transportation, paying to join a job search website, hiring a résumé writer or taking relevant courses.

This list should get you started, but a tax expert such as an enrolled agent (EA) will let you know about any additional documentation needed to complete your return.

Enrolled agents are the only federally licensed tax practitioners who specialize in tax matters and have unlimited rights to represent taxpayers before the IRS.

Learn More

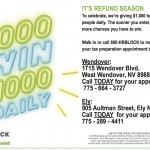

For further information and an appointment,

call your local H&R Block at 1.775.664.3727 in Wendover

or walk in at 1715 Wendover Blvd,

or for Ely, call 775.289.4411 or walk in at 905 Aultman Street.