Barrick Gold

Just a few weeks ago, on Friday, February 22nd, 2019, Canadian-based Barrick Gold Corporation, was considering buying Newmont Mining for a whopping $18 Billion. Last week, Newmont rejected the takeover bid and proposed a joint Nevada joint venture. Barrick Chief Executive Officer Mark Bristow initially seemed cool to Newmont’s joint venture proposal, but later said he was willing to talk with Newmont Chief Executive Officer Gary Goldberg.

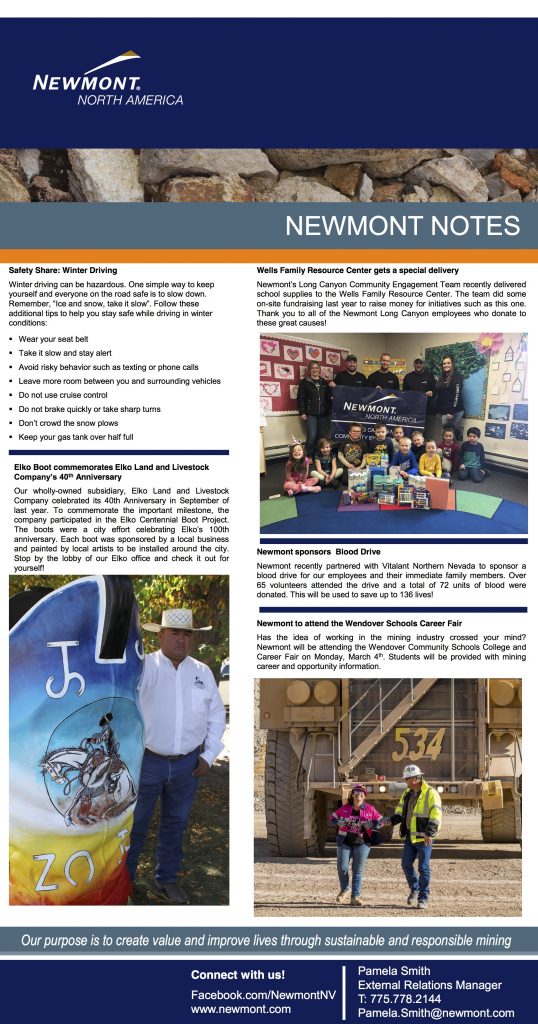

Barrick Gold’s Turquoise Ridge mine in Nevada.(photo credit Barrick Gold Corp.)

Here is the story: At first, Barrick made a $6.1 billion buyout offer of Randgold Resources, and Newmont answered by extending a $10 billion offer to buy their smaller, Canadian rival Goldcorp Inc., a deal which would make Newmont the largest gold miner in the world.

So first Barrick added that it had not considered offering a premium for Newmont shareholders, arguing then that “a premium isn’t necessary as the new, mega-gold miner would lower operating costs to levels neither could do on their own”. Newmont responded later: “We do not intend to speculate on Barrick’s interest or motivation,” said Omar Jabara, Newmont Spokesman. “We remain confident that the combination of Newmont and Goldcorp represents an unparalleled opportunity to create value for our shareholders and deliver industry-leading returns for decades to come.”

Back in 2014, Barrick Gold and Newmont were previously talking about the idea of a possible merger, but discussions fell apart. In effect, Barrick and Newmont have been talking to each other for the last 20 years or so.

Such major acquisitions have been largely dormant in the gold sector for the past few years, with most companies focusing on cutting costs as investors grow increasingly critical of how management teams managed their capital.

Barrick hosted a community meeting in downtown Elko last Monday morning where Barrick President and CEO Mark Bristow shared details of the agreement.

“I met with Gary Tuesday night in New York and told him that we can do this, but the drop-dead date is Sunday,” Bristow said. “He came up to meet with me with his whole team on Wednesday.”

Bristow said the two companies’ teams put together the full documentation for the joint venture in time for a Sunday night signing.

The joint venture will be incorporated as an LLC, which will be owned 61.5 percent by Barrick and 38.5 percent by Newmont, and will be operated by Barrick. Barrick will control three seats on the board and Newmont will control two seats. There will be technical, finance and exploration advisory committees with equal representation from Barrick and Newmont.

Following completion of the joint venture, the Nevada complex will be the world’s single largest gold producer, with pro forma output of more than 4.0 million ounces in 2018, three Tier one assets, potentially another one in the making, and 48 million ounces of reserves.

Barrick Gold shares advanced on the news, rising 1.27% or 22 cents, to $17.56 on volume of 5.6 million shares traded.

Goldcorp jumped to a day high of $14.77 on Monday, before slipping back to $14.40 for a gain of 0.14% or $0.02.

Newmont Mining shares rose 2.43% or US82 cents to US$32.89.

No name yet for the joint venture has been decided.

Barrick’s North American headquarters is in Henderson, but the joint venture offices will be in Elko. Greg Walker is moving to Elko to be the leader of the joint venture.

“This agreement represents an innovative and effective way to generate long-term value from our joint assets in Nevada, and represents an important step forward in expanding value creation for our shareholders,” Newmont CEO Gary Goldberg said Monday. “Through the joint venture, we will also continue to pursue the highest standards in safety, along with responsible and meaningful engagement with our employees, communities, and other stakeholders.”

Newmont, in the meantime, is proceeding with its proposal to combine with Goldcorp Inc., and will hold a special shareholder meeting on this merger on April 11.

“Combining with Goldcorp represents a compelling value creation opportunity for Newmont’s shareholders providing them with an unmatched portfolio of world class operations, projects, exploration opportunities, reserves and talent,” Newmont CEO Gary Goldberg said in a press release Monday.

Newmont plans to move its North American regional office from Elko to Vancouver, Canada, when it joins with Goldcorp.

The mines in the Barrick-Newmont joint venture will include Barrick’s Cortez, Goldrush, Goldstrike, Turquoise Ridge, and South Arturo; and Newmont’s Carlin, Long Canyon, Phoenix, Twin Creeks and Lone Tree.

There are a few regulatory steps which have to have to be gone through, but Bristow said he does not anticipate a problem with this, since the two companies are remaining intact and are just creating a joint venture. The joint venture is expected to be finalized within the coming months.

The Nevada Gold Venture will produce 4.1 million ounces of gold, according to information released by Barrick on Monday. That makes that Gold Venture by far the largest gold mine in the world. In second place is the Olimpiada Mine in central east Siberia in Russia, which produces 1.3 million ounces of gold. The Nevada Complex, if it was ranked as a gold company, would be in third place, behind Barrick with 5.7 million ounces and Newmont with 5.1 million ounces of gold.

Bristow said that there will be savings in many different areas, but that the impact on the workforce should be minimal. There will probably be some reduction in overlap in management, although Bristow said “it makes no sense for Newmont and Barrick to seek to get rid of any expertise.”

“Nevada has been dancing around this issue of unification for many years,” Bristow said in an interview Monday morning. “You just have to drive on the road and see the amount of Newmont trucks going one way and the Barrick trucks going the other way, and the congestion, and the workers traveling all over the place. It just doesn’t look like an efficient engineering endeavor.”

Bristow talked about the adjacent Turquoise Ridge and Twin Creeks mines as an example of the how the joint venture will change the way things are done. Barrick now pays a premium to process ore in Newmont’s processing plant. The joint venture will allow Barrick to reduce the costs of processing their ore, “which means that we can drop the grade at which we are still profitable, giving us the opportunity to extend the life of both Turquoise Ridge and Twin Creeks. And at the same time there’s been this ongoing argument about land and mineral rights, because Twin Creeks would like to have some of our mineral rights, and we don’t want to give it to them, and so we compromise their ability to expand and utilize their invested capital, their infrastructure. If you remove all that, you have real synergies.” said Bristow.

The joint venture will also provide opportunities for savings in warehouses, railheads and roads and with more direct travel routes.

“We also spend about $10 million a year checking on each other because we don’t trust each other,” Bristow said. With a joint venture, all that money would be saved.

Barrick is working on developing its Fourmile project and Newmont is working on developing the deposits at Mike and Fiberline. If these mining areas meet certain criteria, they will be added into the joint venture.

Bristow said that with these and other expansion projects, the joint venture will have opportunities to employ more people, along with opportunities to move people and equipment from older mines to newer projects as older mines come to the end of their life.

When the joint venture hires people, Bristow said, they will put an emphasis on hiring local people first.

Bristow, a native of South Africa, has been the CEO of Randgold Resources Ltd. since 1995 and became the CEO of Barrick when the companies merged Jan. 1 of this year. Randgold, which focused primarily on developing mines in Africa, has been a successful company through the years, delivering a 4,000 percent return since the end of 1999.

“What I did when we merged with Barrick was to bring my team of two decades, my understanding of the gold industry to Barrick,” Bristow said in Monday’s interview. “The original Barrick back in the ‘80s is what I modeled my company on, and that is very entrepreneurial, agile and modern in its thinking, with a very small head office.”

At the start of Monday morning’s meeting Barrick said he wants the joint venture and the local community to be a partnership with good communication.

“This is the start of that conversation,” Bristow said. “We’re part of Nevada, and we would like to be your partner into the future.”

He said Barrick people and Newmont people will be talking together for the next several days as they plan the course for the future.

“We will be working to build one team with one vision over the next few weeks, and today will be the start of that process,” Bristow said.

At Monday’s community meeting in Elko, Great Basin College President Joyce Helens said the college is very excited about the opportunities in working with the Barrick-Newmont joint venture.

“We have very strong roots with both companies,” Helens said. She said that Great Basin and the Mackay School of Mines at the University of Nevada, Reno will be working with the joint venture to bring a Mining School of Excellence to Elko, which will bring various training programs together under one umbrella.

“This is something we’ve wanted to do for a couple of years, and we thought this is a perfect opportunity now,” Helens said. “I’m excited to bring this to Elko and see what we can do.”

Elko Mayor Reece Keener said the Newmont Legacy Fund has been an important source of revenue for many local organizations, and he asked Bristow about the joint venture’s charitable giving.

“I think what I’d like to be trying to achieve is moving away from charitable support to committed support,” Bristow said. He talked about some of the ways Rangold’s programs have changed people’s lives in Africa.

“We will be looking at the revenues that are supporting those sort of initiatives and making sure that we make them more effective,” Bristow said. “That would be my guidance to the team going forward.”

Elko County Commissioner Jon Karr said he was little surprised at the numbers in the joint venture, with Barrick playing such a dominant role, when there is often a perception that Newmont is the bigger player in Nevada.

Bristow said that although the two companies have similar reserves, Newmont’s reserves are graded at 1.6 grams per ton, whereas Barrick’s are 3.6 grams per ton. Looking at resources, Newmont’s are less than 1.6 grams per ton, whereas Barrick’s are over 4, which is three and a half times higher than the industry average. Analysts base their valuations on these numbers, along with infrastructure and other factors. The valuations of about eight analysts were averaged to come up with the joint venture numbers.

“Both parties had to accept the valuations, which we have,” Bristow said. “And I think that was always the gristle in Nevada. There was the view that one had more value than the other. That’s why over many attempts we didn’t get to a solution, and the only people that really suffered were the shareholders in both companies.”

Caleb McAdoo, a biologist with the Nevada Department of Wildlife, said that Barrick and Newmont have had different ways of managing the land which they own, and he asked what approach the joint venture will take.

“I’m a very passionate hunter and conservationist,” Bristow said. “We manage our impact on the environment in a very rigorous and transparent manner. If there’s any way we can do a better job going forward, we will. We want to protect habitat, and make sure we are honest and transparent about our impacts on the environment. And I’m excited to see how we can do this, excited about working with you. Every one of us should live this.”

Elko contractor and city councilman Robert Schmidtlein asked Bristow about the joint venture’s stance toward unions.

“Randgold is the only gold company in the world that invites union leadership onto our operating boards,” Bristow said. “I don’t see that as a challenge at all, because if we are good employers and we are investing in our people, unionized work forces make it much easier to interface with your work force. One of the first things we’ll be doing is to sit down with our workers and tell them our business model, our business formula. In all our companies we share the results on a monthly and quarterly basis. We want our workforce to be part of the value and creating change.”

With the news of the joint venture, Barrick Gold Corp stock finished at $13.18 Monday, up 1.85 percent. Newmont Mining Corp dropped more than three percent Monday morning, but finished at $33.45, down 0.77 percent.

Barrick Gold Corporation and Newmont Mining Corporation said Monday March 11th, 2019, that the two companies have signed an implementation agreement to create a joint venture combining their respective mining operations, assets, reserves, and talent in Nevada.

This joint venture is an historic accord between the two gold mining companies, which have operated independently in Nevada for decades, but have previously been unable to agree terms for cooperation. The joint venture will allow them to capture an estimated $500 million in average annual pre-tax synergies in the first five full years of the combination, which is projected to total $5 billion pre- tax net present value over a 20-year period.(Synergies arise out of cost reductions, due to efficiencies in the newly combined firm. Alternatively, they may arise due to new net incremental revenues.)

Barrick President and Chief Executive Officer Mark Bristow said the agreement marked the successful culmination of a deal that had been more than 20 years in the making.

“We listened to our shareholders and agreed with them that this was the best way to realize the enormous potential of the Nevada goldfields’ unequalled mineral endowment, and to maximize the returns from our operations there. We are finally taking down the fences to operate Nevada as a single entity in order to deliver full value to both sets of shareholders, as well as to all our stakeholders in the state, by securing the long-term future of gold mining in Nevada,” he said.

Gary Goldberg, Chief Executive Officer of Newmont, said the logic of combining the two companies’ operations was compelling.

“This agreement represents an innovative and effective way to generate long-term value from our joint assets in Nevada, and represents an important step forward in expanding value creation for our shareholders. Through the joint venture, we will also continue to pursue the highest standards in safety, along with responsible and meaningful engagement with our employees, communities, and other stakeholders,” he said.

Following the completion of the joint venture, the Nevada complex will be the world’s single-largest gold producer, with a pro forma output of more than four million ounces in 2018, three Tier One2 assets, potentially another one in the making, and 48 million ounces of reserves.

The establishment of the joint venture is subject to the usual conditions, including regulatory approvals, and is expected to be completed in the coming months. The joint venture will exclude Barrick’s Fourmile project and Newmont’s Fiberline and Mike deposits, pending the determination of their commercial feasibility.

As a result of this agreement, Barrick has withdrawn its Newmont acquisition proposal announced on February 25, and its proposals for the Newmont annual general meeting submitted on February 22.

Newmont is a leading gold and copper producer. The Company’s operations are primarily in the United States, Australia, Ghana, Peru and Suriname. Newmont is the only gold producer listed in the S&P 500 Index and was named the mining industry leader by the Dow Jones Sustainability World Index in 2015, 2016, 2017 and 2018. The Company is an industry leader in value creation, supported by its leading technical, environmental, social and safety performance. Newmont was founded in 1921 and has been publicly traded since 1925.

In short:

• Historic joint venture designed to unlock $5 billion1 in synergies

• Barrick to be Operator

• Ownership to be 61.5% Barrick; 38.5% Newmont

• Board representation based on ownership

• Advisory committees to have equal representation

• Barrick to withdraw Newmont acquisition and AGM proposals

Note: On march 1st, 2018, five years after being appointed CEO of Newmont, Newmont Mining Corporation announced that its President and Chief Executive Officer, Gary J. Goldberg, received the Charles F. Rand Memorial Gold Medal for his leadership and contributions to the mining industry in “transforming organizations to elite status of value, sustainability and safety.” The award was presented by the American Institute of Mining, Metallurgical, and Petroleum Engineers (AIME) during the 2018 Society for Mining, Metallurgy & Exploration conference.