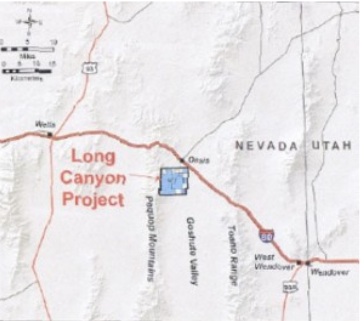

The Long Canyon Mine is on its last leg of permitting process just in time perhaps as gold enters a super cycle.

According to a Newmont Gold press release the Long Canyon project the Draft Environmental Impact Study (DEIS) is now open for a 45 day public comment period during which community members are invited to offer input that will ultimately help shape the development of the project.

The process began in 2012 and has cleared every bureaucratic hurdle remaining on track to begin construction in 2015.

While Newmont was dotting every ‘i’ and crossing every ’t’ gold experienced a slump in 2013 trading at around $1,100 an ounce.

Hundreds of workers were laid off by area mines in the western half of Elko County.

Hundreds of workers were laid off by area mines in the western half of Elko County.

Some locals feared a return to the bad old days of the late 1990’s and early 2000’s when the market crashed to well below $400 an ounce triggering a local recession that devastated the economy.

At the turn of the millennium hundreds if not thousands of jobs were lost and rural Nevada was plunged into deep recession because of the gold death spiral. Experts were predicting that gold would never again seen the $700 an ounce mark of the late 1970’s, and the odds were long against the precious metal would reach again the $450 sweet spot that made gold ming profitable for Nevada mines.

At the turn of the millennium hundreds if not thousands of jobs were lost and rural Nevada was plunged into deep recession because of the gold death spiral. Experts were predicting that gold would never again seen the $700 an ounce mark of the late 1970’s, and the odds were long against the precious metal would reach again the $450 sweet spot that made gold ming profitable for Nevada mines.

However according to commodities analyst Gary Wagner gold may be headed for a two perhaps four year long “super cycle” that could push the price of the precious metal even beyond the highs of $1,900 an ounce last seen three years ago.

However according to commodities analyst Gary Wagner gold may be headed for a two perhaps four year long “super cycle” that could push the price of the precious metal even beyond the highs of $1,900 an ounce last seen three years ago.

Wagner has been a technical market analyst for over 25 years. A frequent contributor to STOCKS & COMMODITIES Magazine, he has also written for many financial publications including Futures Magazine as well as Barron’s.

According to his commentary “Chart This” on the Kitco Precious metals website, Wagner said that even before the current crisis in the Ukraine gold had already bottomed out of it year long spiral that devastated the Nevada mining industry in 2013.

Those fears are in vain Wagner predicted and added that the signs are that gold is not only ready to return to record levels it may even eclipse them.

Even before the crisis in the Crimea gold had already returned to the $1,300 an ounce mark indicating that the market had recovered and that the sell off had stopped.

And now with the current political crisis the precious metal should recover its former highs and perhaps exude them Wagner said.

There are several reasons to be optimistic he explained first gold is regaining its luster as a safe haven for investors that was tarnished a year ago by the unexpected drop.

There are several reasons to be optimistic he explained first gold is regaining its luster as a safe haven for investors that was tarnished a year ago by the unexpected drop.

More practically is that gold knows no border. Should the Ukrainian crisis continue without resolution the West is sure to impose more economic sanctions and restrictions on trade with Russia. A sure way to sidestep those trade restrictions is instead of using dollars, euros or other currency is to make them in gold.

In addition to political unrest in Europe there is also an economic crisis brewing in China. All that bad news is good news for the Nevada mining industry and the Nevada economy. Both for current projects such in the Carlin Trend and new ones such as Long Canyon Mine.

Even before the slide in the price of gold ended, Newmont Mine official insisted of that work on the Long Canyon Mine project 30 miles west of Wendover would continue unabated.

Even before the slide in the price of gold ended, Newmont Mine official insisted of that work on the Long Canyon Mine project 30 miles west of Wendover would continue unabated.

“Of course we have had to adjust and reevaluate,” said Newmont Mining executive Mary Korpi. “Some projects have been put on the back burner but the Long Canyon project is not one of them.”

Newmont commitment to the project will probably not dissipate no matter what this year since it is still in the permitting/exploration phase and with the earliest construction start date estimated for mid 2015 any fluctuation in the price of gold this year is essentially irrelevant for the Long Canyon project.